We keep hearing from clients that they never knew they could use an independent building surveyor to oversee the insurance reinstatement of their property. Here are a few reasons why it is better to use RMA Surveyors Ltd, an independent chartered building surveyor, to oversee the reinstatement of your property.

We keep hearing from clients that they never knew they could use an independent building surveyor to oversee the insurance reinstatement of their property. Here are a few reasons why it is better to use RMA Surveyors Ltd, an independent chartered building surveyor, to oversee the reinstatement of your property.

Larger insurance brokers offer their own in-house surveyors to oversee fire, flood, water and impact damage claims to property. These companies will appoint the services of their surveyors, to act on your behalf, after they have undertaken their initial assessment of the damage to your property. Often these brokers do not fully explain that you are not obliged to use their in-house surveyor’s services. You are free to appoint your own independent surveyor to specify, tender and oversee works on your behalf under your policy cover. Because your insurance policy covers the fees of an independent surveyor, like RMA Surveyors Ltd , it will not cost you a penny to get impartial, qualified and quality advice and management for the duration of the insurance reinstatement works.

Using an independent chartered building surveyor like RMA Surveyors Ltd is a better option for many reasons. Firstly, using RMA Surveyors Ltd guarantees you are using a qualified professional who is regulated by the Royal Institution of Chartered Surveyors (RICS). As RICS surveyors we are governed by a code of conduct and must act reasonably and impartially at all times.

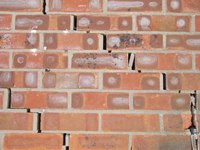

Secondly, as chartered building surveyors we are professionally obliged to undertake projects diligently and must have the resources and capacity to fulfil a project. Large insurance broker surveyors often have many projects on the go at any one time over a large geographical area. They do not have the time to provide a tailored, bespoke service to each project. Consequently they cannot provide the same attention to detail, often missing important elements critical to the smooth completion of the project. A high turnover of staff and reallocation of resources in these companies can mean you deal with a number of different surveyors. Often works can be specified by the broker’s in-house surveyors by using template documents that do not fit the criteria of an individual project. RMA Surveyors Ltd provide a personal service with a meticulous approach, tailored to each individual property.

Thirdly, RMA Surveyors Ltd provide a fully accountable service which is efficient, detailed and comprehensive at all stages of the project. We also understand the stress and upheaval caused by such events as flood, fire, impact and water damage and endeavour to provide swift reinstatement of your property. As a result of their limited resources, broker’s in-house surveyors are often difficult to contact, do not properly oversee the quality of materials and workmanship on site, are slow to react to problems that arise and provide incomplete documentation.

Lastly, RMA Surveyors Ltd ensure that all works are undertaken by quality independent building contractors, using industry standard building contracts which protect you and clearly define your rights. Therefore, in the unlikely event that something does go wrong you are protected. Often broker’s in-house surveying departments use contracts that heavily favour themselves and their own approved contractors; effectively absolving them of responsibility should a problem arise.

If you have an insurance claim that is causing undue stress or you need some free advice please contact us. We would welcome the opportunity to help you.